SOLUTIONS TAILORED FOR LARGER BUSINESSES

ENTERPRISE | باقة الشركات

For established and financial services regulated companies looking to enhance their diligence and comply with current regulatory requirements. Access a full stack of Financial Crime Management tools. Scroll down to find out more.

Powerful compliance

tools to protect your organisation

Comprehensive Financial Crime Prevention

Our ICA-certified experts are here to guide you toward the right solutions and services for your compliance needs. With advanced intelligence for corporate risk management, we provide risk assessments, biometric verification, and bespoke reports

- empowering regulated businesses with deep insights and seamless, automated compliance.

Key features include:

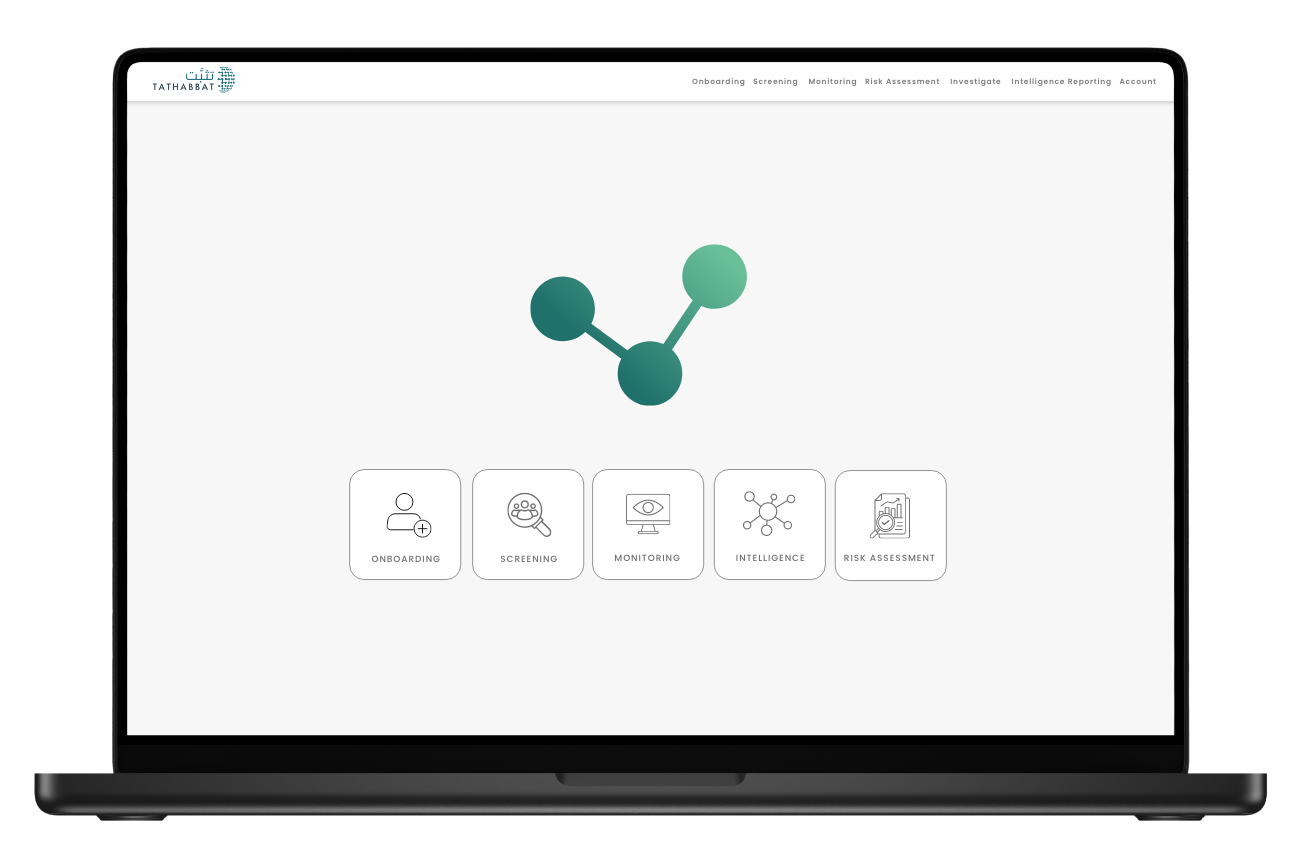

ALL-IN-ONE PLATFORM

Screen, monitor and investigate, all in a single platform

DIGITAL RISK ASSESSMENT

An intuitive, online tool that helps you create a proactive & positive anti-financial crime culture and meet your regulatory challenges.

Bespoke Intelligence Reports

Request in-depth due diligence reports on any entity, anywhere

Access To Experts

A dedicated customer success team to guide you through best practices

REDUCE TIME & COSTS

Onboarding

- End-to-End Digital Onboarding

- Identity & address verification

- Customisable workflows & approvals

Onboarding is a digital-first, automated solution designed to streamline the end-to-end customer onboarding process, ensuring compliance, efficiency, and scalability. As a core module, it provides a seamless experience for KYC, KYB, and risk assessment while meeting global regulatory requirements.

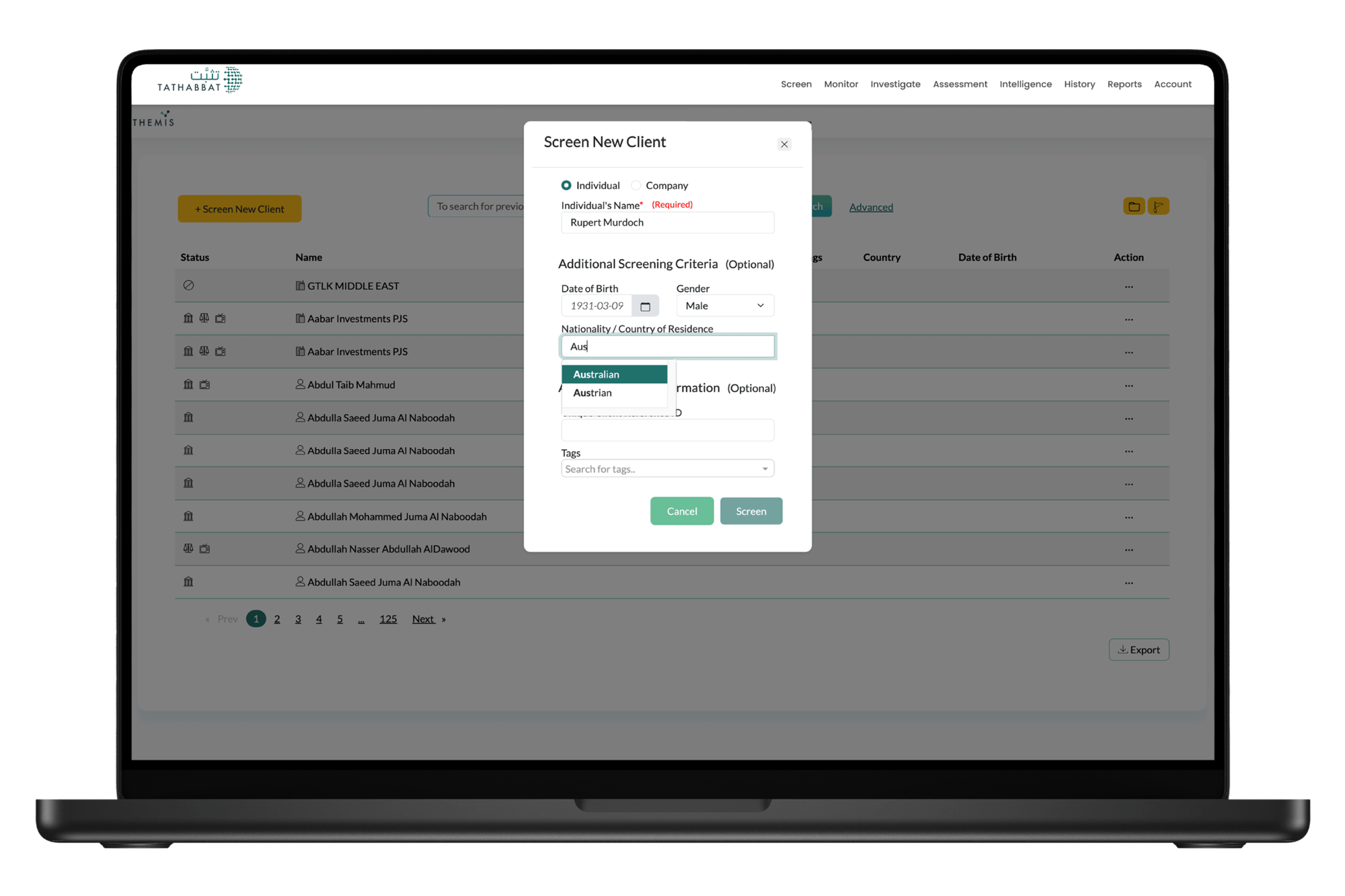

GET INSTANT CHECKS

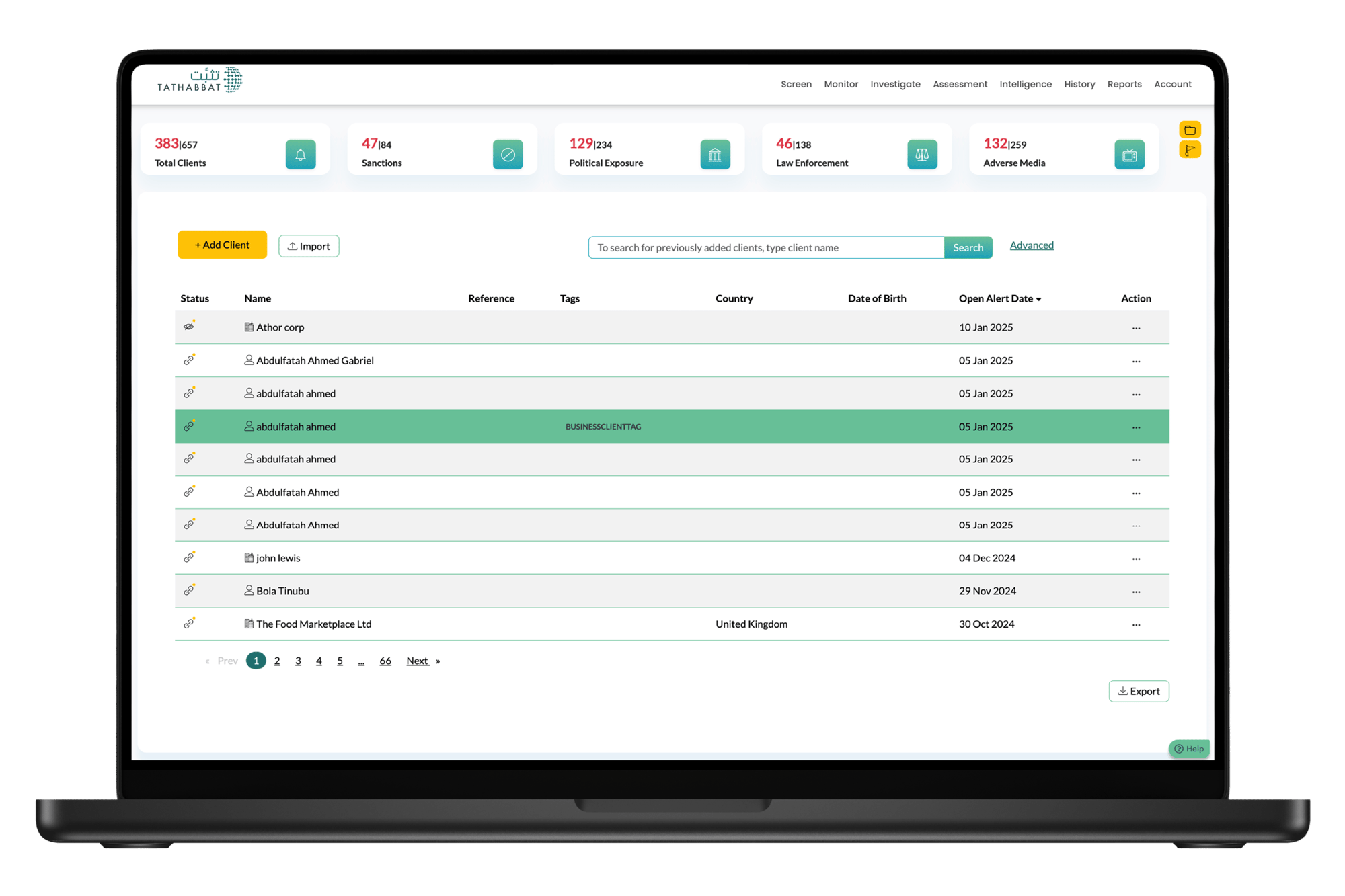

Screening

- Screen a tailored number of entities, per year

- Screen against sanctions, PEPs, litigation, adverse media outlets

- Search against watchlist data

Screen your clients, suppliers, investors and investments against sanctions, PEPs, litigations, adverse media, criminal records and corporate registries. Platform performs screening against the watchlist data and generate potential hits for users to review through intuitive UI platform.

KEEP AN EYE ON CHANGING RISK

Monitoring

- 24 hour ongoing monitoring of legal entities and individuals

- Batch upload data

- Sanctions watchlists updated every 6 hours

The platform performs ongoing monitoring of legal entities and individuals on daily basis against sanctions, PEPs, litigations, adverse media, criminal records and corporate registries. The data can be fed to monitoring platform via manual input, batch upload or through API Integration. Monitoring platform provides a user friendly dashboard to indicate newly generated alerts by the system on ongoing basis.

UNCOVER UNKOWN RISK

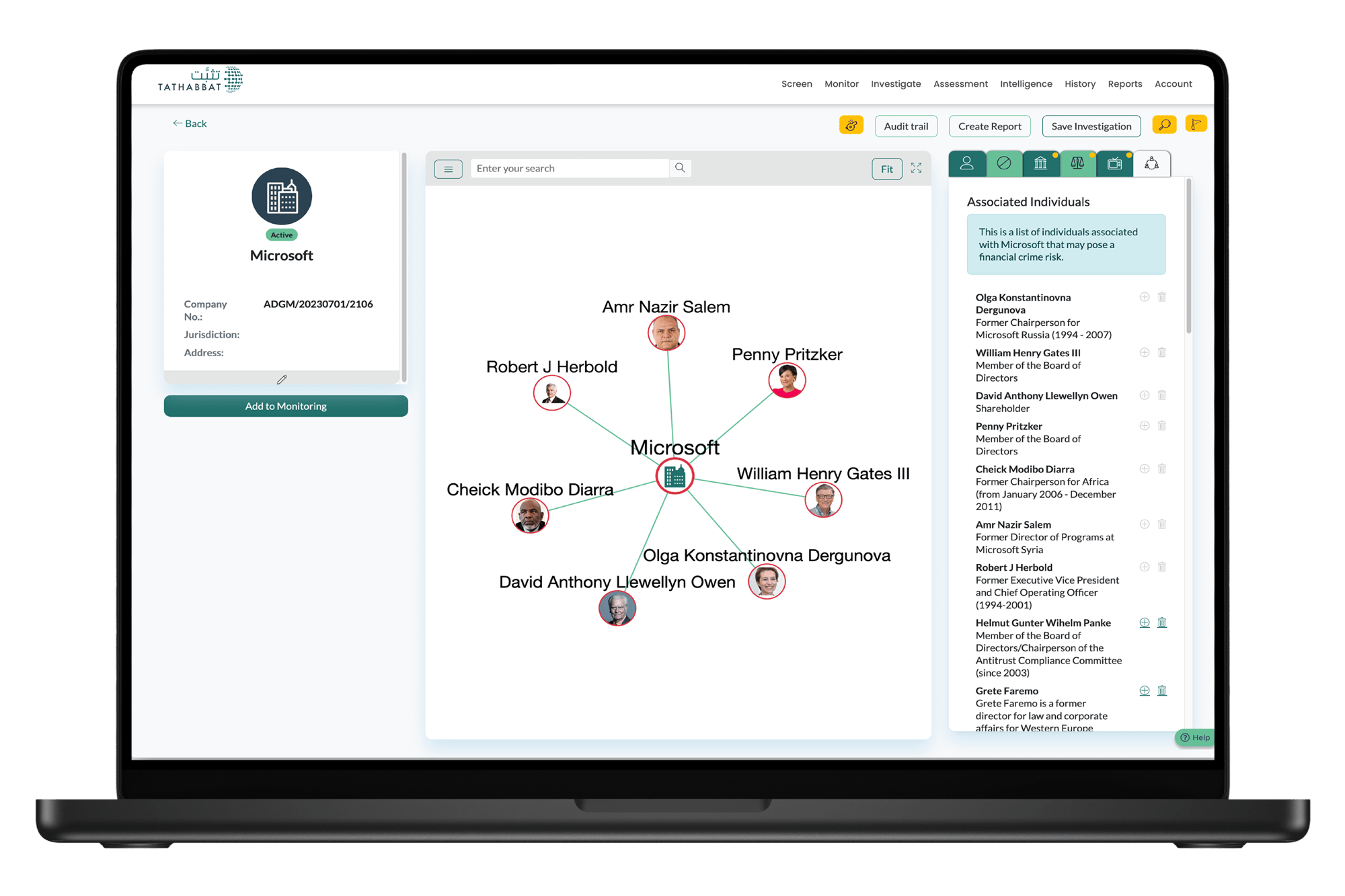

Investigate

- Search & investigate legal entities & individuals for links to financial crime

- Unlimited 1 EDD Reports *

- Develop network risk maps

Create a detailed risk map to show the different risks associated with a person or company of interest.

*Level 2 & 3 EDD reports available on individual pricing

TURN RISK INTO ACTIONABLE INSIGHTS

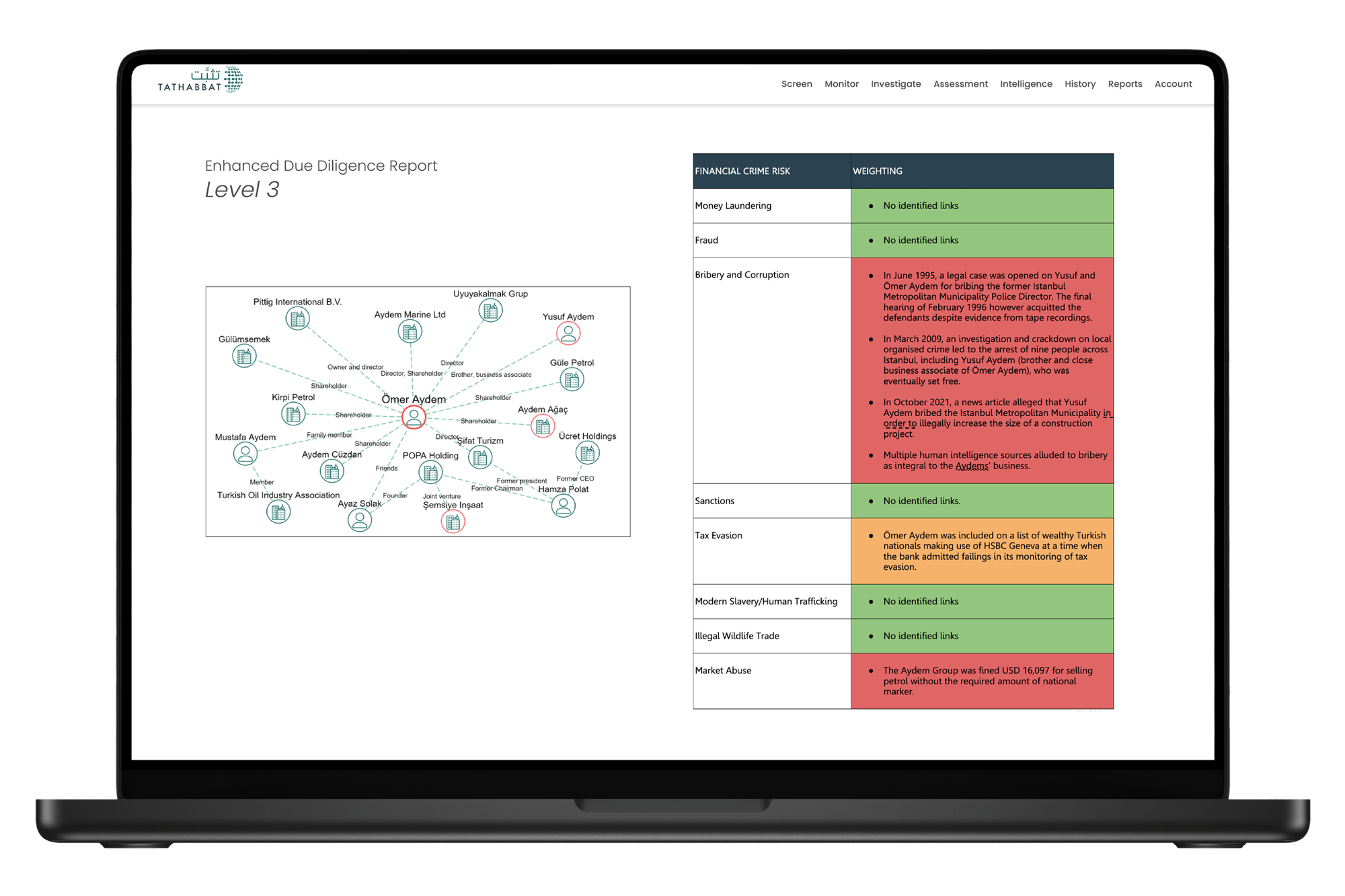

Intelligence Reporting

- Bespoke Enhanced Due Diligence reports

- Level 2 & 3 repository, all-in-one secure location

- Audit trail capability

Request an Enhanced Due Diligence & Intelligence report (Levels 2 or 3) on individuals and companies.

BRING YOUR CLIENTS INTO THE FOLD

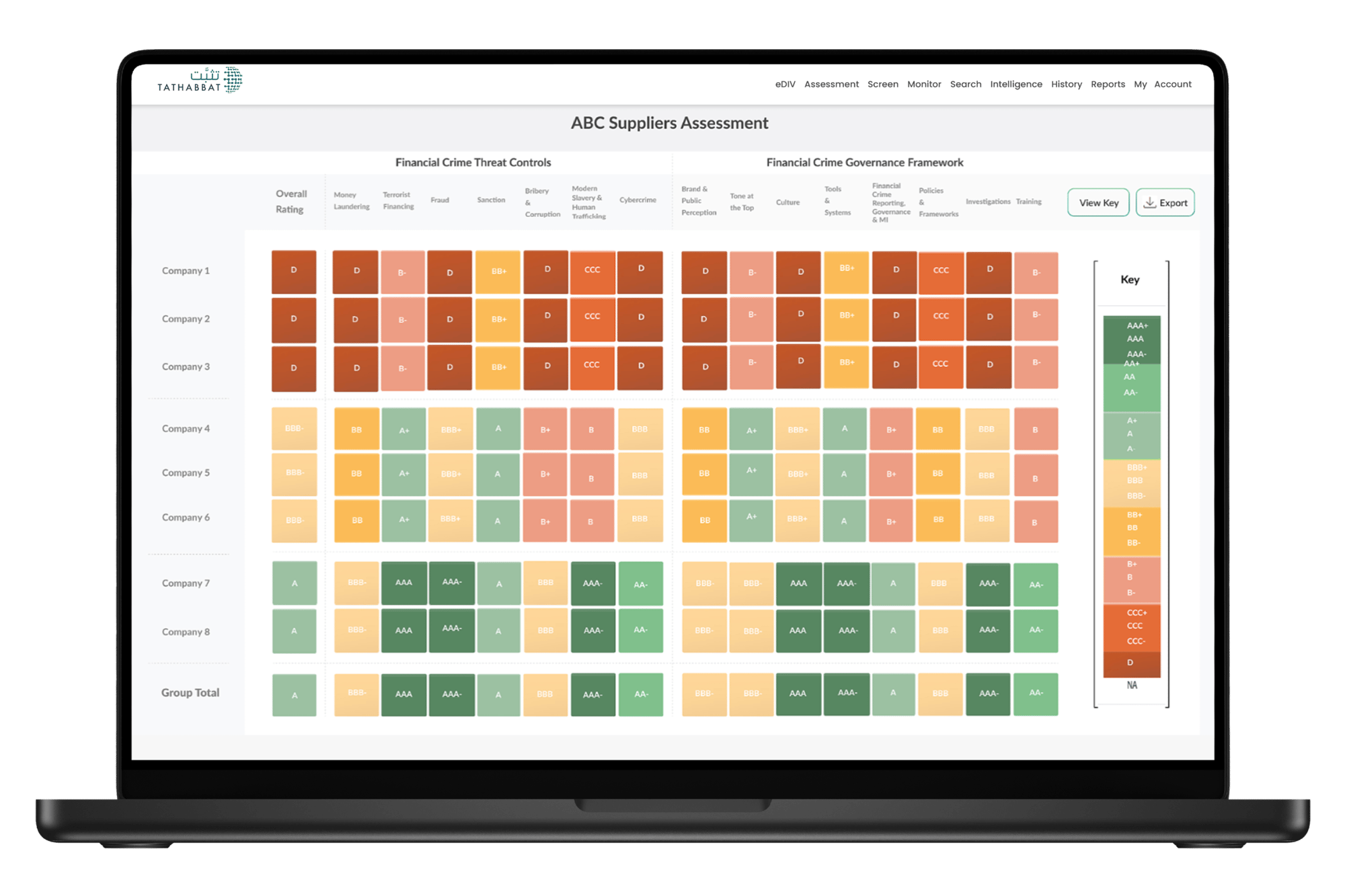

Risk Assessment

- Meet your legal & regulatory requirements for outsourcing arrangements

- Get a holistic view of all of your 3rd party risk in one heatmap.

- Stay alerted to changes with ongoing monitoring

Assess 3rd party suppliers against financial crime risks and analyse the results in real time, enabling you to identify areas of high risk and take proactive measures to mitigate those risks.

Customer Success

Customer Success goes beyond support - it’s about partnership, guidance, and proactive problem solving.

It’s that personal touch that ensures you’re not just using our platform, but maximising its value.

Our dedicated Customer Success team is here to understand your evolving challenges, tailor solutions to your needs, and provide expert insights that help you navigate financial crime risks with confidence. Whether it’s onboarding, ongoing support, or adapting the platform as your business grows, we’re with you every step of the way.

Your financial crime risk profile is unique to your business and will evolve over time.

We understand this, and we’ll work with you as your business grows to modify, adapt, and evaluate new functionality & customisations, helping your business stay resilient and ahead of emerging threats.

“Beyond the technology, Themis offers exceptional value for money - the comprehensive features and support we receive far outweigh the investment. What truly sets them apart is not just their cutting-edge technology, but their outstanding team.”

Jannes Coetsee CA(SA), CFA

Advance Global Capital

Discover our other products