IDEAL FOR SMALL BUSINESSES

CORE | الباقة الأساسية

As a small business owner, you work hard to grow and build trusted relationships with employees, investors, and suppliers. But in today’s world, how can you be sure that a new client, or investor is truly legitimate? From fraudulent suppliers to investments that later prove to be tied to sanctioned entities, the risks are real and the consequences can be costly.

Could you unknowingly be enabling financial crime?

Being involved in financial crime may seem distant, but you’d be surprised how easily it impacts businesses like yours.

With the right tools, you can easily protect your business and do your part in combating financial crime

- It’s that simple.

Hidden Risk

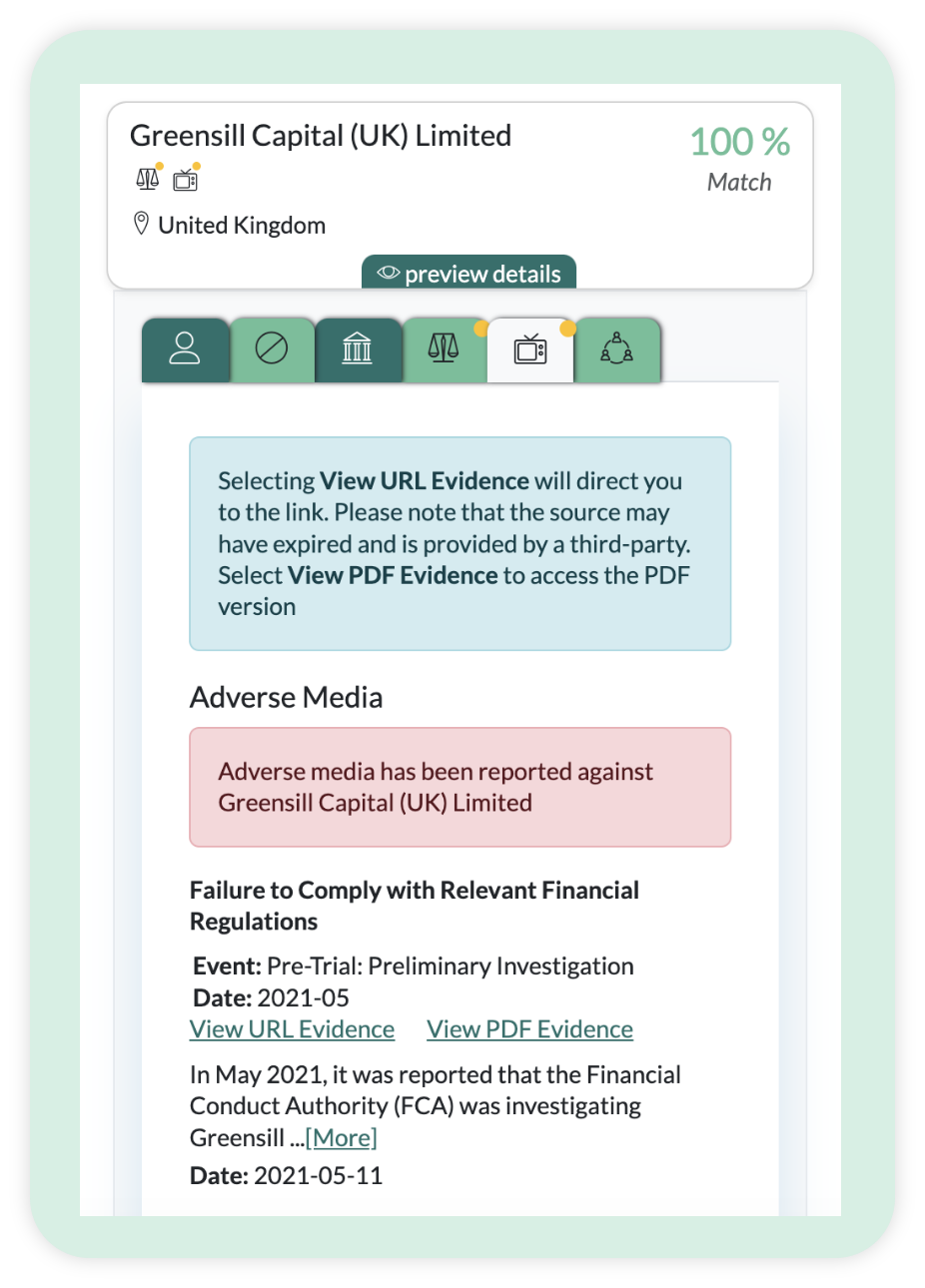

Greensill Capital, a renewable energy start-up secured funding from an investment firm promising rapid growth. Later, it was revealed that the firm was running a Ponzi scheme.

Real Impact

The start-up lost credibility, investors pulled out, and the business collapsed before its product launch.

The Solution

Unfortunately unlike other CORE and EXTENDED Users, Greensill Capital did not Search for the CEO on the Tathabbat platform, which could have saved them from going into Liquidation in 2021.

Grow your business

& reduce your risk.

FINANCIAL CRIME PREVENTION

Your path to reducing your financial risk

CORE gives you one user licence and 60 credits to screen your choice of clients, suppliers, investors and individuals.

Key features include:

Screening & Monitoring

Instantly check clients,

suppliers, investors, and employees.

Investigation Tool

No compliance expertise

needed - search anytime, anywhere.

24/7 Alerts & Notifications

Be notified of updates and risks in real-time.

Support

Q&A guides, videos, and webinars, all designed to help you learn about AML

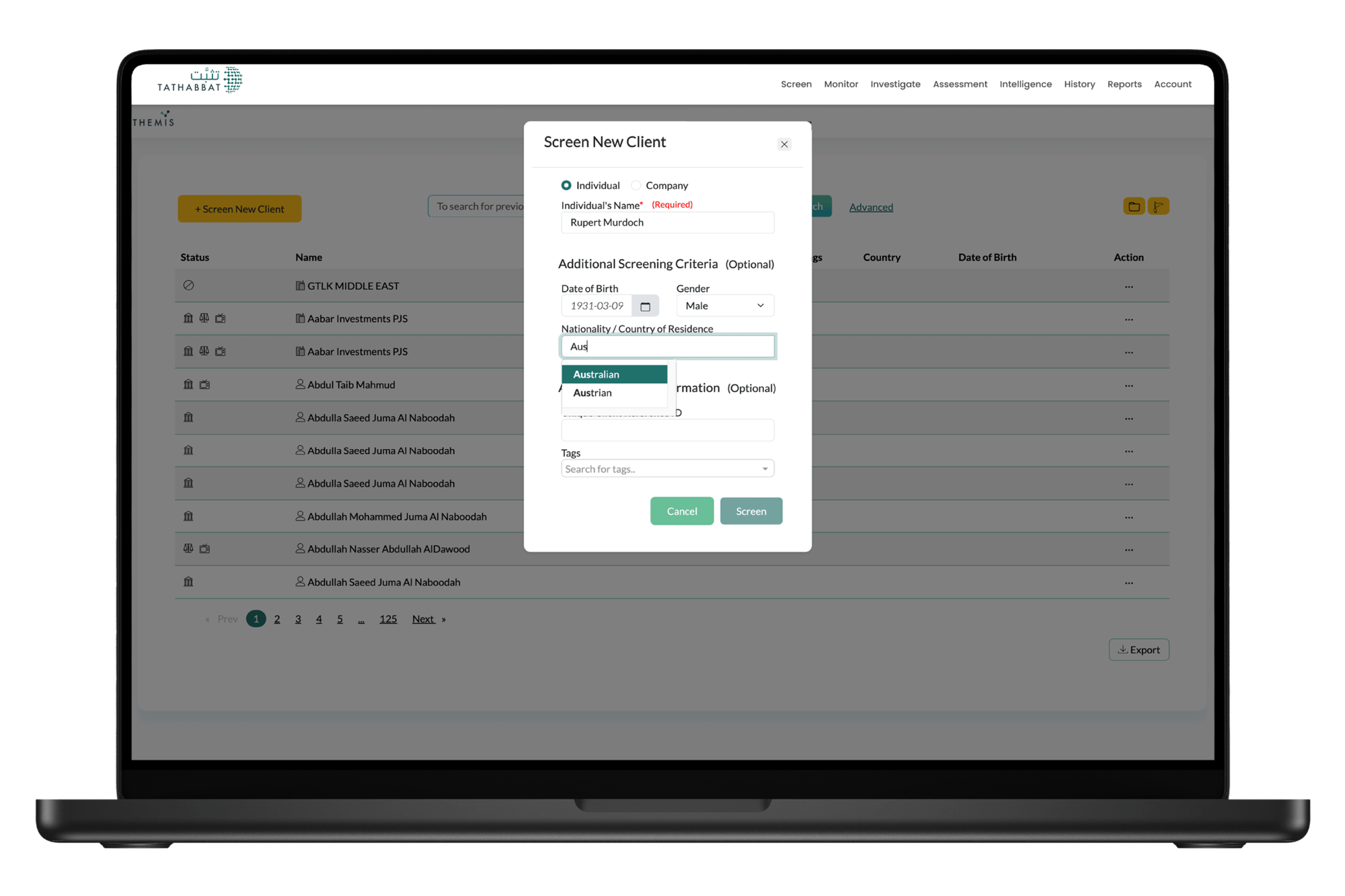

GET INSTANT CHECKS

Screening

- Screen up to 60 entities

- Sanctions, PEPs, litigation, adverse media outlets

- Search against watchlist data

Screen your clients, suppliers, investors and investments against sanctions, PEPs, litigations, adverse media, criminal records and corporate registries. Platform performs screening against the watchlist data and generate potential hits for users to review through intuitive UI platform.

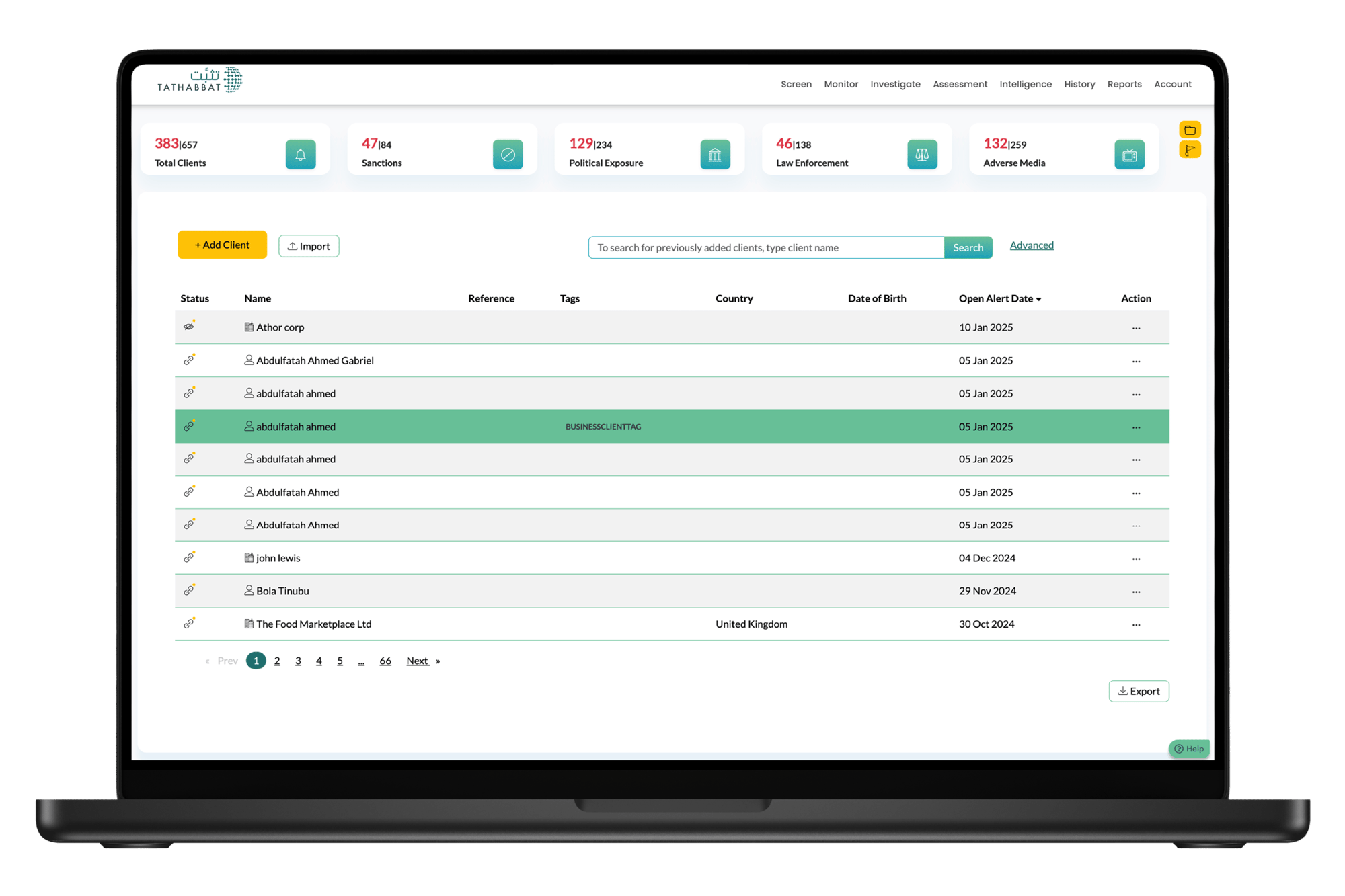

KEEP AN EYE ON CHANGING RISK

Monitoring

- 24 hour ongoing monitoring of legal entities and individuals

- Batch upload data

- Sanctions watchlists updated every 6 hours

The platform performs ongoing monitoring of legal entities and individuals on daily basis against sanctions, PEPs, litigations, adverse media, criminal records and corporate registries. The data can be fed to monitoring platform via manual input, batch upload or through API Integration. Monitoring platform provides a user friendly dashboard to indicate newly generated alerts by the system on ongoing basis.

Stay Ahead. Protect Your Business

Get instant access to essential due diligence tools — no complexity, no steep learning curve.

Quickly screen individuals and companies, ensuring your business remains compliant and secure.

Monthly

SAR 390